Instituto de Estudos de Fundos Soberanos

Taking care of today’s wealth to ensure a sustainable long-term future.

Governance

This is a fundamental pillar for a Sovereign Wealth Fund to achieve solid results for society.

Transparency

Managing resources properly is an obligation for all Sovereign Wealth Funds. Showing the results transparently is a way to keep growing.

The Future

Combining principles of governance and transparency allows Sovereign Wealth Funds to reduce potential vulnerabilities and gain longevity.

About the IEFS

Created in 2023, the IEFS(in english, Institute for Sovereign Wealth Fund Studies ) is a private and independent entity made up of academics and researchers whose main objective is to study the universe of Sovereign Wealth Funds with the aim of generating technical knowledge, transferring this knowledge and contributing to the development of these wealth instruments so that they can solidify themselves in an environment of constant and growing challenges, and thus reach the highest levels of institutional structure, risk management, transparency and accountability, making them World Class Sovereign Wealth Funds.

Instituto de Estudos de Fundos Soberanos

What IEFS does?

IEFS produces studies, research, and analysis that allow constant debates and evaluations (National Ranking of Sovereign Wealth Funds) on Sovereign Wealth Funds. The experience and technical knowledge of IEFS researchers enable guidance and exchanges of experience with sovereign wealth funds currently in operation and help in structuring new funds.

Ranking

The institute draws up the National Ranking of Regional Sovereign Wealth Funds using the MAFS (Portuguese acronym for Sovereign Wealth Fund Evaluation Model). The purpose of evaluating the funds is to identify the best practices in terms of governance and transparency in each one of the funds and to promote the exchange of experiences in the search for best practices adoption.

MAFS

The MAFS is a tool composed of twenty "Verification Items" that seek to identify the evidence that attests to the degree of governance and transparency clearly and objectively, which is one of the prerequisites for sovereign wealth funds to reach the "World Class" level. The answer to each of the questions implicit in the verification items must be of the "closed" type, i.e. "yes" or "no". For each "yes" answer, one (1) point is added to the overall score. Answers of the "no" type do not score and the number (0) zero is assigned to the respective check item.

About Brazilian sovereign wealth funds

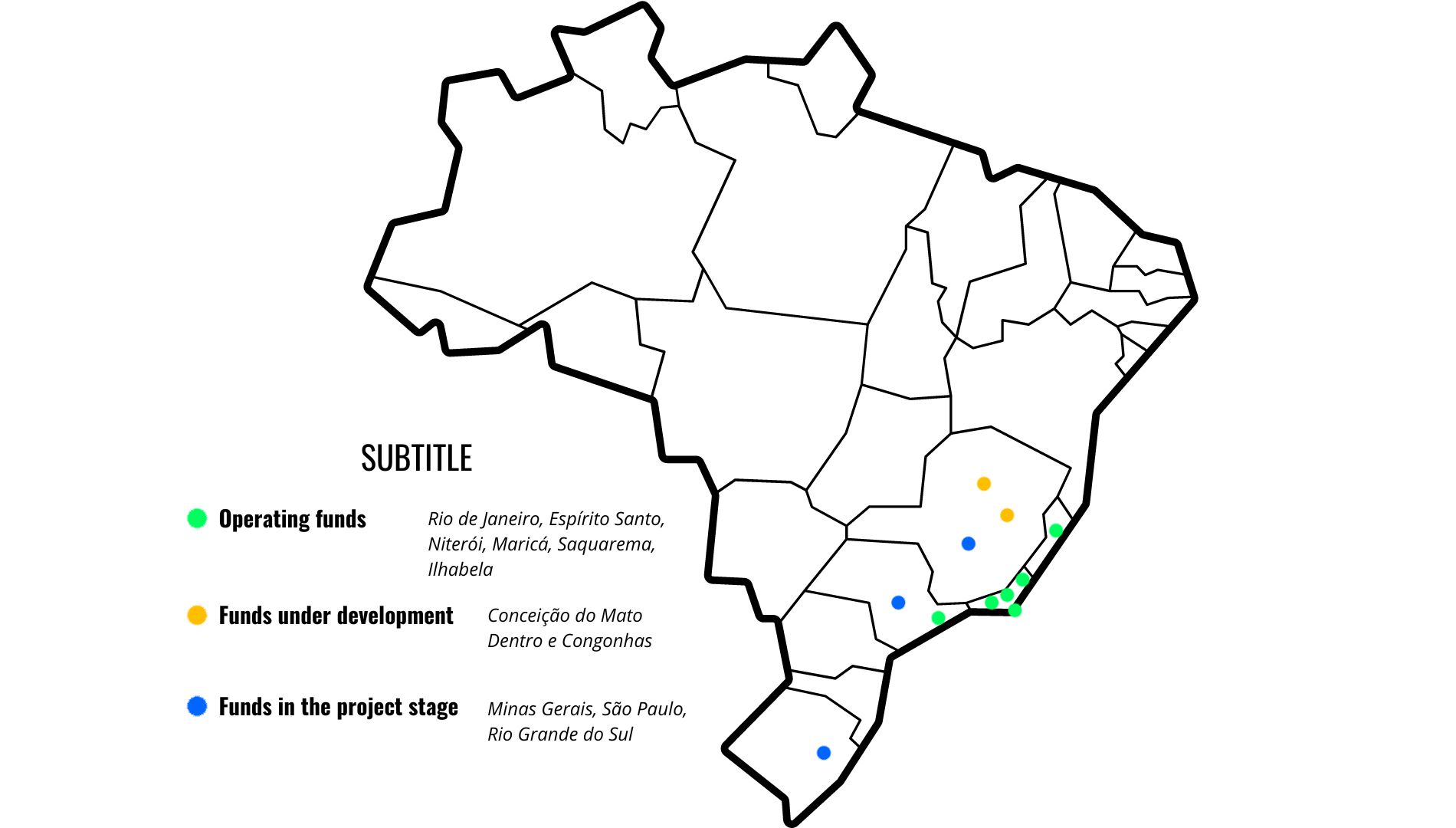

Brazilian sovereign wealth funds

0

In Operating

0

Development

0

Project

Brazilian Funds

Profile of Brazilian Sovereign Wealth Funds in operational

Click on the buttons below to see the profile of each Sovereign Wealth Funds currently operating in Brazil.

Sovereign Wealth Funds assets in 2023

VALUES IN BILLIONS OF REAIS

Rio de Janeiro

0

Espírito Santo

0

Maricá

0

Niterói

0

Ilhabela

0

Building the Future Together

Services We Provide

Revenue Projection.

Strategic Planning for Sovereign Wealth Funds.

Set up to adopt best practices.

Structuring nascent Sovereign Wealth Funds.

Input-output matrix for Sovereign Wealth Funds.

Sovereign Wealth Fund Incubator.

PDCA applied to Sovereign Wealth Funds.

Routine Management for Sovereign Wealth Funds.

IEFS Content

Frequently Asked Questions

What is a Sovereign Wealth Fund?

It is a state investment fund or entity (national or regional) set up with the aim of transferring gains from extraordinary revenues (revenues from royalties and special participations, balance of payments surpluses and privatization proceeds) to future generations, using long-term investments for this purpose. Sovereign Wealth Funds can have different objectives such as intergenerational savings, stabilization, financing, diversification of the asset portfolio, development (regional or national), social and strategic. For the time being, only in Portuguese; Os Fundos Soberanos podem ter objetivos distintos como: poupança intergeracional, estabilização, financiamento, diversificação da carteira de ativos, desenvolvimento (regional ou nacional), social e estratégico.

What is the source of sovereign wealth funds?

The majority of the capital managed by Sovereign Wealth Funds comes from revenues from royalties and special participations, balance of payments surpluses and privatization proceeds.

Why should a city, state or country have a sovereign wealth fund?

Among other reasons, a Sovereign Wealth Fund can be used to invest in initiatives that are not a priority for the private sector.

What do SWFs invest in?

Sovereign Wealth Funds have a wide range of investment options, which are selected according to the fund's objective. These investments can be made in government bonds, shares, investment funds, infrastructure, the acquisition of a stake in or the totality of strategic companies.

Does Brazil have a national sovereign wealth fund?

There is no longer a National Sovereign Wealth Fund in Brazil. The Fundo Soberano Brasileiro (in english, Brazilian Sovereign Fund) was created in 2008 with assets of 5.3 billion dollars, between high oil prices on the international market and the recent discovery of the pre-salt layer, and had its activities closed in 2019. The FSB's purpose was to reduce the impact of economic cycles, build up public savings, make investments in Brazil and abroad and enable the creation of strategic projects in general.

What is the function of Brazilian subnational sovereign wealth funds?

Brazil's subnational funds have different roles, which can be defined according to their objectives, ranging from promoting companies that work in regional development to using them for initiatives that mitigate the negative impacts caused by extraordinary and unpredictable events, such as the COVID-19 pandemic.